Indian state-owned Mazagon Dock Shipbuilders Ltd. (MDL) acquired stake in Sri Lanka’s Colombo Dockyard PLC (CDPLC) for up to $52.96 million. The deal covers at least 51% of CDPLC’s equity and includes shares held by Japan’s Onomichi Dockyard Co. Ltd. (the previous majority owner). The transaction is expected to close within four to six months, pending regulatory approvals. Upon completion CDPLC will become a subsidiary of MDL. MDL a leading Indian warship and submarine builder says this is its first overseas acquisition and a milestone in its evolution from a purely domestic shipyard to a regional maritime player.

Deal Highlights:

- MDL to acquire ≥51% of Colombo Dockyard for up to $52.96M.

- Includes Onomichi Dockyard’s entire 51% stake in CDPLC.

- Structured as a mix of new equity and purchase of existing shares.

- Expected close in 4–6 months, then CDPLC becomes MDL subsidiary.

- Colombo Dockyard (est. 1974) is Sri Lanka’s largest shipyard with over 50 years of experience; 2024 turnover LKR 25.45 B ($85M).

- The yard has four dry docks (largest 125,000 DWT) and multiple berths.

- Mazagon Dock’s own FY2024/25 revenue was ₹114.32 B (~$1.34B).

- First foreign acquisition by an Indian shipbuilder; CDPLC will be MDL’s 100%-owned subsidiary after closing

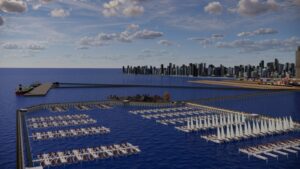

Colombo Dockyard has built a variety of large vessels for clients around the world. Colombo Dockyard PLC has been Sri Lanka’s flagship shipbuilding and repair yard for over five decades. It runs four dry docks (the largest handling up to 125,000 DWT) and multiple repair berths, servicing over 200 vessels per year. Over the years CDPLC has delivered complex ships – from cable-layers and offshore support vessels to tankers and patrol craft – for customers in Asia, Europe, the Middle East and Africa. This extensive capability – including in-house design, steel fabrication and ISO-certified operations – makes CDPLC Sri Lanka’s only yard offering a full integrated shipbuilding and repair portfolio.

Sri Lanka’s Colombo Dockyard lies on one of the world’s busiest shipping routes, giving India a strategic Indian Ocean outpost. The location of Colombo Dockyard – in Sri Lanka’s main port on the Indian Ocean – is highly strategic. It sits just off the busy East–West shipping lanes, giving MDL a strong operational foothold in one of the world’s most geopolitically significant maritime corridors. Indian officials and analysts note that this acquisition helps balance China’s influence in Sri Lanka. ( Sri Lanka’s Hambantota Port – on the island’s south coast – was leased to China Merchants Port Holdings for 99 years in 2017 after Colombo failed to service its debt.)

India has long watched Chinese Investments in Sri Lankan ports with concern, and MDL’s move effectively adds an Indian “forward outpost” on its southern flank. In the words of Reuters, the deal “is seen giving India a strategic foothold in the Indian Ocean island nation where New Delhi and Beijing have been pushing for influence for years”. Business Standard similarly notes the deal’s significance “amid the increasing assertiveness of Chinese in the Indian Ocean region and its presence in India’s neighbourhood”.

Economic and Operational Synergies

The acquisition is also expected to harvest important commercial and technical cooperation. MDL plans to integrate Colombo Dockyard into its shipbuilding and supply chain network. For example, senior officials say that a number of repair and refit orders from India and abroad can now be diverted to CDPLC, ensuring a continuous revenue stream and relieving capacity pressure at Mumbai. In PTI’s words, MDL “will bring an order pipeline for CDPLC from both domestic and international markets for repairs, refits and new builds,” creating new work for the Colombo yard.

At the same time, MDL can offload some of its workload to Sri Lanka’s facilities, speeding up project completion on both sides. Company officials also highlight that the two yards’ decades of collected expertise can be pooled. As noted in reports, the “detailed design capabilities possessed by both the yards can be leveraged” on projects at either shipyard. This design and engineering cooperation along with shared R&D and access to common suppliers is expected to lower costs and boost productivity across the two facilities.

Also Read : INS Tabar Rescues 14 crew from oil tanker fire in Gulf of Oman

Key synergies include –

- Diversified workload: MDL can channel more repair and construction work through Colombo Dockyard, ensuring a steady income stream, while CDPLC taps into MDL’s order pipeline for new builds.

- Shared expertise: Combining the engineering teams and design talent of MDL and CDPLC unlocks operational efficiencies. Both yards’ decades of know-how can be harnessed for joint projects.

- Technology transfer: Access to MDL’s naval shipbuilding technology and Indian supply chains should help modernize Colombo Dockyard. MDL’s investment and technical support are expected to aid the debt-laden CDPLC’s turnaround.

- Expanded markets: CDPLC has an existing order book exceeding $300 million. Through MDL’s backing, these orders can tap into Indian and allied markets. Conversely, MDL gains a gateway to customers in Sri Lanka, the Maldives, Southeast Asia and Africa via CDPLC’s regional presence.

Overall, MDL says the deal will “strengthen its position in the shipbuilding and ship repair industry by unlocking operational synergies, enhancing [R&D] capacity and expanding market reach”. By integrating Colombo Dockyard’s resources, MDL aims to create a more efficient, multi-location maritime enterprise.

Regional Impact and Outlook

Beyond economics, the move has clear geopolitical overtones. Indian analysts view it as part of a broader push to secure South Asian maritime routes and counter Chinese influence. MDL’s official statement clearly tied the deal to India’s maritime strategy: it said the acquisition “envisages India’s emergence as a leading maritime power with strong regional integration and industrial capabilities,” helping to build a “multi-location shipbuilding enterprise” anchored in Indian expertise.

In practical terms, the Colombo Dockyard acquisition essentially binds Sri Lanka’s naval infrastructure to New Delhi’s maritime supply chain. As one security commentator put it, India is stitching together a “South Asian Maritime Arc” – a chain of ports and repair hubs that would enhance its ability to project power and monitor activity in the Indian Ocean.

For Sri Lanka, the deal also has appeal as a commercial lifeline. Colombo Dockyard has struggled with low utilization and debt; Indian capital booster and management is expected to revive the yard. Sri Lankan officials welcome the partnership as job-creating and technology-building. The Minister of Ports has called it “not only an economic deal but also a demonstration of regional cooperation” that will boost skills and naval capacity. In effect, the MDL acquisition signals to other investors that Sri Lanka is diversifying its partnerships and not solely reliant on Chinese firms.

India’s move likewise sends a message: when financial distress creates an opening, New Delhi is ready to step in on its own terms. This quietly expands India’s influence in Colombo, just as Chinese influence has grown in the Hambantota Port lease. So far, Beijing has offered no public reaction to the shipyard deal, with Chinese analysts calling it “predictable” and unlikely to endanger China’s long-term projects in Sri Lanka. But some local experts in Colombo speculate that an expanded Indian role could eventually lead to joint exercises or intelligence sharing – developments that China would watch carefully.

In sum, the MDL–Colombo Dockyard partnership is more than a business transaction – it represents a strategic forward outpost for India in a zone of intense great-power competition, bolstering its maritime supply chain and diplomatic presense in the Indian Ocean.