Over the past week, the Red Sea has emerged as one of the world’s most dangerous shipping lanes. A spate of high‑profile attacks by Yemen’s Iran‑aligned Houthi rebels on merchant vessels has reignited fears of a broader maritime conflict, drawing in international naval operations and triggering demands from seafarer unions for enhanced protections. At the same time, Israeli airstrikes against Houthi‑held ports have compounded the crisis by damaging critical infrastructure. These developments come against the backdrop of a fragile ceasefire in the wider Middle East and illustrate the increasingly blurred lines between commercial shipping and frontline hostilities.

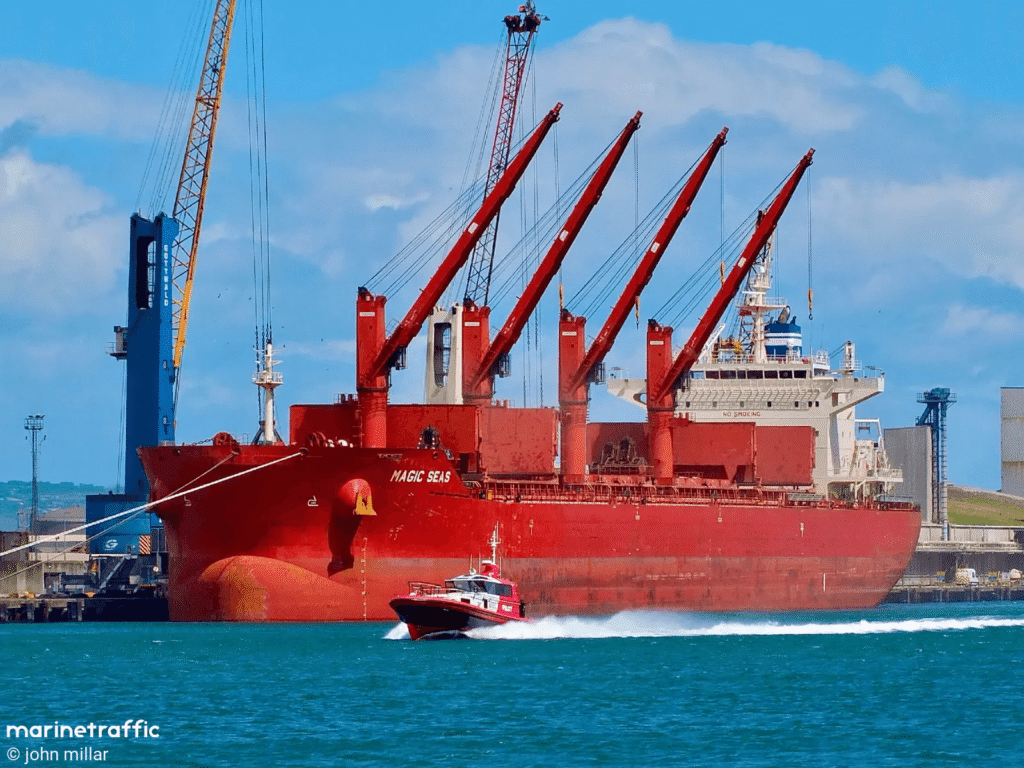

Houthi Rebels Claim Sinking of the Magic Seas

On July 6, 2025, the Liberian‑flagged bulk carrier Magic Seas, operated by Greek firm Stem Shipping, was struck by a coordinated Houthi attack approximately 51 nautical miles southwest of Hodeidah, Yemen. According to Houthi military spokesman Yahya Saree, the assault involved two unmanned surface vessels (USVs), five ballistic missiles and three drones, after an initial volley of gunfire and rocket‑propelled grenades from small skiffs. The vessel, laden with iron ore and fertilizer bound from China to Turkey, began taking on water, forcing its 19‑member crew to abandon ship into life rafts. They were rescued by the Djibouti‑based containership Safeen Prism and disembarked safely in Djibouti later that day.

The Houthis went on to claim the Magic Seas had ultimately sunk beneath the waves, although this has yet to be independently verified by shipping insurers or naval monitors. If confirmed, the sinking would mark the third merchant vessel lost to Houthi action since November 2023, when the group began its maritime campaign in solidarity with Palestinians in Gaza. The attack also shattered half a year of relative calm in the southern Red Sea, where merchant traffic had cautiously resumed after a lull in incidents since December 2024.

Follow‑on Assault on the Eternity C

Just 24 hours later, on July 7, the Greek‑managed bulker Eternity C came under a similar assault some 50 nautical miles from Hodeidah. Ambrey, a London‑based maritime security firm, reported that the attack combined small‑boat gunfire, sea drones, and precision strikes on the vessel’s bridge, disabling its engines and communications systems. Two crew members—among a complement of 22 (21 Filipinos and one Russian)—were seriously wounded, while two others remain missing.

The attackers, identified as Houthi militants, reportedly drifted in the area even after the initial strike, delaying rescue operations and heightening concerns that they might return to hasten the ship’s sinking—an warning tactic they have employed in past engagements. The European Union’s Operation Atalanta and the United Kingdom Maritime Trade Operations (UKMTO) have issued advisories urging vessels to maintain minimum deck activity, designate safe muster points above the waterline, and avoid proximity to craft without AIS signals to mitigate risk.

Israeli Retaliation and Port Infrastructure Damage

In response to the Houthi attacks, the Israeli Defense Forces (IDF) launched “Operation Black Flag”—a series of airstrikes targeting Houthi‑controlled port facilities at Hodeidah, Ras Isa, and Saleef. Satellite imagery and on‑ground reports confirm significant damage to critical infrastructure, including the Saleef power station, which supplies electricity to grain silos and flour mills essential for humanitarian aid and commercial cargo handling. Two Barbados‑flagged bulk carriers berthed at Ras Isa also suffered collateral blast damage; fortunately, no crew injuries were reported.

The Israeli strikes further risk deepening the shipping paralysis. Port closures and damaged berths have forced shipping lines to reroute vessels around the Cape of Good Hope, adding up to two weeks and hundreds of extra nautical miles to voyages between Europe and Asia. Insurers have responded by hiking war‑risk premiums for all vessels transiting the Red Sea and adjacent Gulf of Aden, escalating freight rates and potentially raising global trade costs.

Seafarer Unions Demand “Warlike Operations” Status

As the conflict intensifies, the International Transport Workers’ Federation (ITF) has urged shipowners and flag states to designate the Strait of Hormuz, Gulf of Oman and Israeli coastal waters as Warlike Operations Areas (WOAs). This classification would entitle seafarers to refuse to enter these zones without penalty and secure risk‑pay allowances commensurate with the dangers they face.

The ITF’s proposal follows the March 2024 designation of the Southern Red Sea and Gulf of Aden as WOAs—an industry first—prompted by a surge of Houthi drone and missile attacks. ITF Seafarers’ Section Chair David Heindel emphasized that commercial crews are “being asked to operate in one of the most unstable and militarized regions” and deserve the right to protect themselves from harm. Major maritime insurers have already listed these waters as war‑risk zones, underscoring the severity of the threat and lending weight to unions’ calls for formal recognition.

International Naval Coordination and Humanitarian Concerns

In the wake of the Magic Seas incident, EUNAVFOR’s Operation Atalanta coordinated the rescue of all 22 crew members, handing them over to the Djibouti Coast Guard and port authorities. The rapid multinational response combining EU naval assets and private security alerts highlights the vital role of international cooperation in safeguarding seafarers and maintaining maritime corridors.

Nevertheless, the conflict’s human toll extends beyond immediate casualties. Humanitarian organizations warn that disruptions to Red Sea ports threaten the delivery of critical food, oil and medical supplies to Yemen and East Africa—regions already grappling with conflict and famine. The bombing of port power stations, in particular, risks crippling grain import and distribution networks, exacerbating hunger and displacement crises.

Economic Impact and Future Outlook

The recent surge in hostilities has sent shockwaves through global supply chains. Container shipping lines including CMA CGM and MSC have partially rerouted vessels around Africa, resulting in higher fuel consumption, longer transit times, and freight rate volatility. Analysts estimate that each diverted vessel incurs an additional US$200,000–300,000 per voyage in operational costs, costs that are likely to be passed on to consumers worldwide.

Looking ahead, the Red Sea shipping crisis shows no immediate sign of abating. Houthi leaders have vowed to maintain their maritime blockade until the Gaza conflict ends, while Israeli officials pledge to continue strikes against Houthi positions in Yemen. Diplomatic efforts by the United Nations, the United States, and regional powers aim to broker a renewed ceasefire, but naval experts caution that without a political resolution, the waterway will remain perilous for years to come.

In this fraught environment, the following measures will be critical:

- Enhanced Naval Escort Operations: Expanded multinational task forces to provide close‑in protection for merchantmen.

- Formal Warlike Area Designations: Adoption of WOAs by flag states and charterers to ensure seafarer rights and compensation.

- Infrastructure Rehabilitation: Swift repair and fortification of port facilities at Hodeidah, Ras Isa and Saleef to avert humanitarian shortages.

- De‑escalation Diplomacy: Urgent dialogue between regional stakeholders to separate maritime security issues from broader geopolitical disputes.

The Red Sea crisis underscores a stark reality, in today’s interconnected world, even localized conflicts can trigger cascading impacts on global trade, food security and human safety. Until a sustainable diplomatic solution is achieved, commercial shipping through the Red Sea will require heightened vigilance, robust international cooperation, and unwavering support for the seafarers on the frontline.

Source: (reuters.com) (splash247.com) (seatrade-maritime.com)